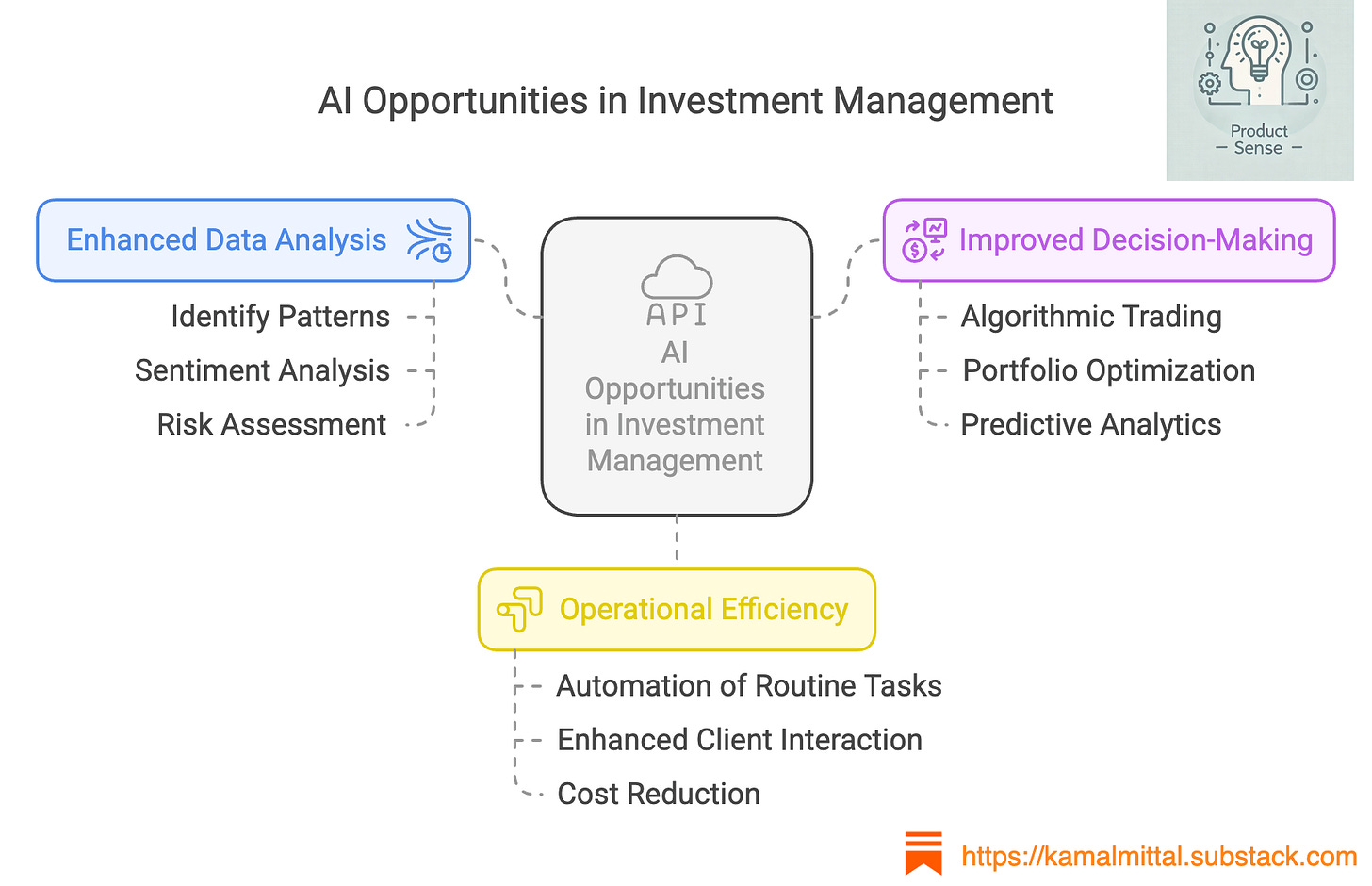

GenAI Opportunities in Investment Management

How can large language models enable portfolio and risk managers with enhanced data analysis, improved decision making and operational efficiency

The rapid advancement of artificial intelligence (AI) technologies presents a wealth of opportunities in the field of investment management. By leveraging AI, investment managers can analyze vast amounts of data, identify trends, and optimize portfolios, ultimately leading to better investment outcomes.

Enhanced Data Analysis

AI algorithms can process and analyze large datasets far more efficiently than traditional methods. This capability allows investment managers to:

Identify Patterns: Machine learning models can uncover hidden patterns in historical data, helping managers make informed predictions about future market movements.

Sentiment Analysis: Natural language processing (NLP) can analyze news articles, social media, and financial reports to gauge market sentiment, providing insights into investor behavior and potential market shifts.

Risk Assessment: AI can enhance risk management by analyzing various risk factors and their potential impacts on investment portfolios, allowing for more informed decision-making.

Improved Decision-Making

AI can support investment managers in making better decisions through:

Algorithmic Trading: AI-driven algorithms can execute trades at optimal times based on real-time data analysis, improving trade execution and reducing costs.

Portfolio Optimization: AI can help in constructing and rebalancing portfolios by analyzing multiple factors, including risk tolerance, market conditions, and investment goals.

Predictive Analytics: By utilizing predictive models, investment managers can forecast market trends and asset performance, enabling proactive investment strategies.

Operational Efficiency

Integrating AI into investment management processes can lead to significant operational improvements:

Automation of Routine Tasks: AI can automate repetitive tasks such as data entry, compliance checks, and reporting, freeing up valuable time for investment professionals to focus on strategic activities.

Enhanced Client Interaction: AI-powered chatbots and virtual assistants can improve client engagement by providing timely information and answering queries, enhancing the overall client experience.

Cost Reduction: By streamlining operations and reducing manual labor, AI can help investment firms lower operational costs and improve profitability.

Conclusion

As the capital markets and investment products continues to evolve, the investment management firms that harness the power of AI will be better positioned to navigate challenges and capitalize on emerging trends. Embracing these technologies is not just an option; it is becoming a necessity for success in the investment management industry.